| 14 | | | Principal Occupation

Co-Managing Partner and Co-Chief Executive Officer, Avista Capital Holdings, LP

Recent Business Experience

Mr. Webster has been the Chairman of our Board of Directors since June 1997. Mr. Webster has served as Co-Managing Partner of Avista Capital Partners LP, a private equity firm focused on investments in the energy, healthcare and other business sectors, since he co-founded the firm in July 2005. From January 2000 until June 2005, Mr. Webster served as the Chairman of Global Energy Partners, Ltd., an affiliate of CSFB Private Equity, which made private equity investments in the energy business. From December 1997 to May 1999, Mr. Webster was the Chief Executive Officer and President of R&B Falcon Corporation, an offshore drilling contractor, and prior to that, was Chairman and Chief Executive Officer of Falcon Drilling Company, which he founded in 1988. Mr. Webster holds an M.B.A. from Harvard Business School where he was a Baker Scholar. He also holds a B.S. in Industrial Management and an Honorary Doctorate in Management from Purdue University.

Other Current Public Company Directorships

Basic Energy Services, Inc. (Chairman)

Camden Property Trust Era Group Inc.

Oceaneering International, Inc.

Public Company Directorships Within the Past Five Years

Geokinetics, Inc.

Hercules Offshore, Inc.

Hi-Crush Partners LP

SEACOR Holdings, Inc.

Reasons for Nomination

Mr. Webster brings to the Board of Directors experience in, and knowledge of, the energy industry, knowledge of the Company as a co-founder and long-time director, business leadership skills from his tenure as chief executive officer of publicly traded companies and his over 30-year career in private equity and investment activities, and experience as a director of several other public and private companies.

PROPOSAL 1. ELECTION OF DIRECTORS

| F. Gardner Parker

Independent

Age: 74

Director Since:2000

Committees:Audit (Chair) and Compensation |

Principal Occupation

Private Investor

Recent Business Experience

Mr. Parker has been the Lead Independent Director of our Board of Directors since May 2012. Mr. Parker has been a private investor since 1984. Prior to that, he worked with Ernst & Ernst (now Ernst & Young LLP) for 14 years, seven of which he served as a partner. In the private sector, Mr. Parker is Chairman of the Board of Edge Resources Ltd, an Energy capital fund and Norton Ditto, a men’s clothing retailer. He is a graduate of The University of Texas at Austin and is board certified by the National Association of Corporate Directors. Mr. Parker is also a 2011 National Association of Corporate Directors (NACD) Board Leadership Fellow. He has demonstrated his commitment to boardroom excellence by completing NACD’s comprehensive program of study for experienced corporate directors-a rigorous suite of courses spanning leading practices for boards and committees-and he supplements his skill sets through ongoing engagement with the director community and access to leading practices.

Other Current Public Company Directorships

Camden Property Trust

Sharps Compliance Corp. (Chairman)

Public Company Directorships Within the Past Five Years

Hercules Offshore, Inc.

Pinnacle Gas Resources, Inc

(nka Summit Gas Resources, Inc.)

Triangle Petroleum Corporation

Reasons for Nomination

Mr. Parker brings to the Board of Directors an extensive background in accounting and tax matters, experience as a director on the boards and audit committees of numerous public and private companies, and financial experience through his involvement in structuring private and venture capital investments for the past 30 years.

| Thomas L. Carter, Jr.

Independent

Age: 64

Director Since: 2005

Committees: Audit and Nominating and Corporate Governance (Chair) |

Principal Occupation

Chairman and Chief Executive Officer,

Black Stone Minerals, L.P.

Recent Business Experience

Mr. Carter has served as President, Chief Executive Officer and Chairman of the general partner of Black Stone Minerals, L.P., a publicly traded mineral acquisition and management company (“BSM”), since its formation in 2014. Mr. Carter is the founder of Black Stone Minerals Company, L.P. (“BSMC”), BSM’s predecessor, and has served as President, Chief Executive Officer and Chairman of its general partner since 1998. Mr. Carter served as Managing General Partner of W.T. Carter & Bro. from 1987 to 1992 and Black Stone Energy Company from 1980 to present, both of which preceded BSMC’s general partner. Mr. Carter founded Black Stone Energy Company, BSMC’s operating and exploration subsidiary, in 1980. From 1978 to 1980, Mr. Carter served as a lending officer in the Energy Department of Texas Commerce Bank in Houston, Texas, after serving in various other roles from 1975. He has served as a Trustee at Episcopal High School in Houston, Texas since 2004, and as a Trustee of St. Edward’s University since 2009. Mr. Carter has been a trustee of a nonprofit since 1998, and was elected to a four-year term as president of the board of trustees of the nonprofit in 2013. Mr. Carter also serves on the University of Texas at Austin Internal Audit Committee, the University Lands Advisory Board, and the Ripley Foundation board. Mr. Carter received M.B.A. and B.B.A. degrees from the University of Texas at Austin.

Other Current Public Company Directorships

Black Stone Minerals, L.P.

Public Company Directorships Within the Past Five Years

None

Reasons for Nomination

Mr. Carter brings to the Board of Directors extensive knowledge of the oil and gas exploration and production business and knowledge of accounting and finance.

PROPOSAL 1. ELECTION OF DIRECTORS  | | | | | | | | | | | | | | |

| | | | Robert F. FultonGardner Parker

Independent

Age: 64

77 Director Since: 2012

2000 Committees: Compensation and Nominating and Corporate Governance |

Principal Occupation

Retired

Recent Business Experience

Mr. Fulton served as President and Chief Executive Officer of Frontier Drilling ASA, an offshore oil and gas drilling and production contractor, from September 2002 through July 2010. From December 2001 to August 2002, Mr. Fulton managed personal investments. Prior to December 2001, Mr. Fulton spent most of his business career in the energy service and contract drilling industry. He served as Executive Vice President and Chief Financial Officer of Merlin Offshore Holdings, Inc. from August 1999 until November 2001. From 1998 to June 1999, Mr. Fulton served as Executive Vice President of Finance for R&B Falcon Corporation, during which time he was instrumental in effecting the merger of Falcon Drilling Company with Reading & Bates Corporation to create R&B Falcon Corporation and the merger of R&B Falcon Corporation with Cliffs Drilling Company. He graduated with a B.S. degree in Accountancy from the University of Illinois and an M.B.A. in finance from Northwestern University.

Other Current Public Company Directorships

Basic Energy Services, Inc.

Public Company Directorships Within the Past Five Years

None

Reasons for Nomination

Mr. Fulton brings to the Board of Directors extensive knowledge of the oil and gas exploration and production business and accounting and finance gained through his roles in executive positions at numerous public and private companies.

| Roger A. Ramsey

Independent

Age: 77

Director Since: 2004

Committees:Audit (Chair) and Compensation (Chair) |

Principal Occupation

Retired

Recent Business Experience

Mr. Ramsey served as Managing Partner of Ramjet Capital Ltd., a private investment firm, from 1999 through January 2013. He served as the Chairman and Chief Executive Officer of MedServe, Inc., a privately held medical waste disposal and treatment company, from 2004 through December 2009. He served as Chairman of the Board of Allied Waste Industries, Inc., a waste recycling, transportation and disposal company, from October 1989 through his retirement in December 1998, and Chief Executive Officer of that company from October 1989 through July 1997. Beginning in 1960, Mr. Ramsey, a certified public accountant, was employed by the international accounting firm of Arthur Andersen LLP. In 1968, Mr. Ramsey co-founded Browning-Ferris Industries, Inc., a waste management company, and served as its Vice President and Chief Financial Officer until 1978. Mr. Ramsey also served as a director of WCA Waste Corporation, a waste management company, from June 2004 through March 2012 when the company was taken private. Mr. Ramsey is currently a member of the Board of Trustees at Texas Christian University.

Other Current Public Company Directorships

None

Public Company Directorships Within the Past Five Years

WCA Waste Corporation

Reasons for Nomination

Mr. Ramsey brings to the Board of Directors experience and perspective as chief executive officer of several publicly traded and private companies and knowledge of accounting and finance as a director of several public and private companies.

| 15Principal Occupation

|

Private Investor CARRIZO OILRecent Business Experience

Mr. Parker has been the Lead Independent Director of our Board of Directors since May 2012. Mr. Parker has been a private investor since 1984. Prior to that, he worked with Ernst & GASErnst (now Ernst & Young LLP) for 14 years, seven of which he served as a partner. In the private sector, Mr. Parker is Chairman of the Board of Edge Resources Ltd, an energy capital fund, Enterprise Offshore Drilling LLC, an offshore drilling service provider, and Norton Ditto, a men’s clothing retailer. He is a graduate of The University of Texas at Austin and is board certified by the National Association of Corporate Directors. Mr. Parker is also a 2011 National Association of Corporate Directors (“NACD”) Board Leadership Fellow. He has demonstrated his commitment to boardroom excellence by completing NACD’s comprehensive program of study for experienced corporate directors, a rigorous suite of courses spanning leading practices for boards and committees and he supplements his skill sets through ongoing engagement with the director community and access to leading practices. Other Current Public Company Directorships | |

Sharps Compliance Corp. Solaris Oilfield Infrastructure, Inc. Public Company Directorships Within the Past Five Years Camden Property Trust Hercules Offshore, Inc. Triangle Petroleum Corporation Reasons for Nomination Mr. Parker brings to the Board of Directors an extensive background in accounting and tax matters, experience as a director on the boards and audit committees of numerous public and private companies, and financial experience through his involvement in structuring private and venture capital investments for the past 30 years. | | | | | | | | | | | | | | |

| | | | Frances Aldrich Sevilla-Sacasa Independent Age: 63 Director Since: 2018 Committees:Audit | Principal Occupation

Private Investor Recent Business Experience Ms. Aldrich Sevilla-Sacasa is a private investor and was Chief Executive Officer of Banco Itaú International, Miami, Florida, from April 2012 to December 2016. Prior to that time, she served as Executive Advisor to the Dean of the University of Miami School of Business from August 2011 to March 2012, Interim Dean of the University of Miami School of Business from January 2011 to July 2011, President of U.S. Trust, Bank of America Private Wealth Management from July 2007 to December 2008, President and Chief Executive Officer of US Trust Company from early 2007 until June 2007, and President of US Trust Company from November 2005 until June 2007. She previously served in a variety of roles with Citigroup’s private banking business, including President of Latin America Private Banking, President of Europe Private Banking, and Head of International Trust Business. Ms. Aldrich Sevilla-Sacasa holds a Bachelor of Arts Degree from the University of Miami and an M.B.A. from the Thunderbird School of Global Management. Other Current Public Company Directorships Camden Property Trust Public Company Directorships Within the Past Five Years None Reasons for Nomination Ms. Aldrich Sevilla-Sacasa brings to the Board of Directors considerable experience in financial services, banking, and wealth management. In addition, her experience as a former president and chief executive officer of a trust and wealth management company, and as a director of other corporate andnot-for-profit boards has provided her with expertise in the area of corporate governance. |

PROPOSAL 1. ELECTION OF DIRECTORS  | | | | | | | | | | | | | | |

| | | | Thomas L. Carter, Jr. Independent Age: 67 Director Since: 2005 Committees:Audit and Nominating and Corporate Governance (Chair) | Principal Occupation President, Chairman, and Chief Executive Officer, Black Stone Minerals, L.P. Recent Business Experience Mr. Carter has served as President, Chairman, and Chief Executive Officer of the general partner of Black Stone Minerals, L.P., a publicly traded mineral acquisition and management company (“BSM”), since its formation in 2014. Mr. Carter is the founder of Black Stone Minerals Company, L.P. (“BSMC”), BSM’s predecessor, and has served as President, Chairman, and Chief Executive Officer of its general partner since 1998. Mr. Carter served as Managing General Partner of W.T. Carter & Bro. from 1987 to 1992 and Black Stone Energy Company from 1980 to present, both of which preceded BSMC’s general partner. Mr. Carter founded Black Stone Energy Company, BSMC’s operating and exploration subsidiary, in 1980. From 1978 to 1980, Mr. Carter served as a lending officer in the Energy Department of Texas Commerce Bank in Houston, Texas, after serving in various other roles from 1975. He has served as a Trustee of St. Edward’s University since 2009. Mr. Carter served as a trustee of a nonprofit from 1998 to 2017, including a four- year term as president of the board of trustees from 2013 to 2017, and presently serves as trustee emeritus of such nonprofit. Mr. Carter also serves on the University of Texas at Austin Internal Audit Committee and the University Lands Advisory Board. Mr. Carter received M.B.A. and B.B.A. degrees from the University of Texas at Austin. Other Current Public Company Directorships Black Stone Minerals, L.P. Public Company Directorships Within the Past Five Years None Reasons for Nomination Mr. Carter brings to the Board of Directors extensive knowledge of the oil and gas exploration and production business and knowledge of accounting and finance. |

| | | | | | | | | | | | | | |

| | | | Robert F. Fulton Independent Age: 67 Director Since: 2012 Committees: Compensation and Nominating and Corporate Governance | Principal Occupation Retired Recent Business Experience Mr. Fulton served as President and Chief Executive Officer of Frontier Drilling ASA, an offshore oil and gas drilling and production contractor, from September 2002 through July 2010. From December 2001 to August 2002, Mr. Fulton managed personal investments. Prior to December 2001, Mr. Fulton spent most of his business career in the energy service and contract drilling industry. He served as Executive Vice President and Chief Financial Officer of Merlin Offshore Holdings, Inc. from August 1999 until November 2001. From 1998 to June 1999, Mr. Fulton served as Executive Vice President of Finance for R&B Falcon Corporation, during which time he was instrumental in effecting the merger of Falcon Drilling Company with Reading & Bates Corporation to create R&B Falcon Corporation and the merger of R&B Falcon Corporation with Cliffs Drilling Company. He graduated with a B.S. degree in Accountancy from the University of Illinois and an M.B.A. in finance from Northwestern University. Other Current Public Company Directorships None Public Company Directorships Within the Past Five Years Basic Energy Services, Inc. Reasons for Nomination Mr. Fulton brings to the Board of Directors extensive knowledge of the oil and gas exploration and production business and accounting and finance gained through his roles in executive positions at numerous public and private companies. |

PROPOSAL 1. ELECTION OF DIRECTORS | | | | | | | | | | | | | | |

| | | | Roger A. Ramsey Independent Age: 80 Director Since: 2004 Committees:Audit and Compensation (Chair) | Principal Occupation Retired Recent Business Experience Mr. Ramsey served as Managing Partner of Ramjet Capital Ltd., a private investment firm, from 1999 through January 2013. He served as the Chairman and Chief Executive Officer of MedServe, Inc., a privately held medical waste disposal and treatment company, from 2004 through December 2009. He served as Chairman of the Board of Allied Waste Industries, Inc., a waste recycling, transportation and disposal company, from October 1989 through his retirement in December 1998, and Chief Executive Officer of that company from October 1989 through July 1997. From 1960 to 1968, Mr. Ramsey, a certified public accountant, was employed by the international accounting firm of Arthur Andersen LLP. In 1968, Mr. Ramseyco-founded Browning-Ferris Industries, Inc., a waste management company, and served as its Vice President and Chief Financial Officer until 1978. Mr. Ramsey also served as a director of WCA Waste Corporation, a waste management company, from June 2004 through March 2012 when the company was taken private. Mr. Ramsey is currently a member of the Board of Trustees at Texas Christian University. Other Current Public Company Directorships None Public Company Directorships Within the Past Five Years None Reasons for Nomination Mr. Ramsey brings to the Board of Directors experience and perspective as chief executive officer of several publicly traded and private companies and knowledge of accounting and finance as a director of several public and private companies. |

| | | | | | | | | | | | | | |

| | | | Frank A. Wojtek

Independent

Age: 60

63 Director Since: 1993

Committees: Nominating and Corporate Governance |

Principal Occupation

President and Director, A-Texian Compressor, Inc.

Recent Business Experience

Mr. Wojtek is currently the President and Director of A-Texian Compressor, Inc., a natural gas compression services company, and has served in various capacities with that company since July 2004. Mr. Wojtek served as our Chief Financial Officer, Vice President, Secretary and Treasurer from 1993 until August 2003. From 1992 to 1997, Mr. Wojtek was the Assistant to the Chairman of the Board of Reading & Bates Corporation, an offshore drilling company. Mr. Wojtek has also held the positions of Vice President, Secretary and Treasurer of Loyd & Associates, Inc., a private financial consulting firm, since 1989. Mr. Wojtek held the positions of Vice President and Chief Financial Officer of Griffin-Alexander Drilling Company from 1984 to 1987, Treasurer of Chiles-Alexander International Inc. from 1987 to 1989, and Vice President and Chief Financial Officer of India Offshore Inc. from 1989 to 1992, all of which were companies in the offshore drilling industry. Mr. Wojtek holds a B.B.A. in Accounting with Honors from The University of Texas at Austin.

Other Current Public Company Directorships

None

Public Company Directorships Within the Past Five Years

None

Reasons for Nomination

Mr. Wojtek brings to the Board of Directors knowledge of the Company and the energy industry by virtue of his service as an executive officer or director of the Company since its founding, experience in accounting and experience in financial executive positions at public and private companies.

| 2016 PROXY STATEMENTPrincipal Occupation

| President and Director, A-Texian Compressor, Inc. 16Recent Business Experience

| |

Mr. Wojtek is a founder and currently the President and a Director of A-Texian Compressor, Inc., a natural gas compression services company, and has served in various capacities with that company since July 2004. In addition, Mr. Wojtek is a landowner and actively manages several ranch properties with oil and gas mineral rights, which total over 32,000 acres in South and West Texas. Mr. Wojtek served as our Chief Financial Officer, Vice President, Secretary and Treasurer from 1993 until August 2003. From 1992 to 1997, Mr. Wojtek was the Assistant to the Chairman of the Board of Reading & Bates Corporation, an offshore drilling company. Mr. Wojtek has also held the positions of Vice President, Secretary and Treasurer of Loyd & Associates, Inc., a private financial consulting firm, from 1989 to 2013. Mr. Wojtek held the positions of Vice President and Chief Financial Officer of Griffin-Alexander Drilling Company from 1984 to 1987, Treasurer of Chiles- Alexander International Inc. from 1987 to 1989, and Vice President and Chief Financial Officer of India Offshore Inc. from 1989 to 1992, all of which were companies in the offshore drilling industry. Mr. Wojtek holds a B.B.A. in Accounting with Honors from The University of Texas at Austin. Other Current Public Company Directorships None Public Company Directorships Within the Past Five Years None Reasons for Nomination Mr. Wojtek brings to the Board of Directors knowledge of the Company and the energy industry by virtue of his service as a prior executive officer and director of the Company since its founding, experience in accounting and experience in financial executive positions at public and private companies, management experience and knowledge in the oil and gas services industry, as well as knowledge and experience in the industry from a land and mineral owner perspective. |

PROPOSAL 1. ELECTION OF DIRECTORS Director Compensation The Company usesCompany’sNon-Employee Director compensation, which is reviewed annually by the Compensation Committee and approved by the Board consists of a combination of cash and equity-based compensation designed to attract and retain qualified candidatesindividuals to serve on the Board.Board and align the interests of directors with those of our shareholders. In determining the level ofNon-Employee Director compensation, the Compensation Committee considers the significant amount of time directors spend fulfilling their duties as well as the competitive market for skilled directors. The annual service period for our directors is the period from one shareholders meeting to the next with cash compensation paid in quarterly installments and equity awards granted upon joining the Board and after their election by shareholders at each annual shareholder meeting. The Company also reimburses travel, meal, and lodging expenses incurred by our non-employee directorsNon-Employee Directors to attend Board and Board committee meetings. In setting director compensation, the Company considers the significant amount of time that directors expendcommittee meetings and to participate in fulfilling their duties to the Company as well as the skill-level required by the Company of members of its Board. S. P.director education programs. Mr. Johnson, IV, our President and Chief Executive Officer, receives nodoes not receive additional compensation for serving on the Board as aan employee director.

The Compensation Committee engages Pearl Meyer & Partners, LLC (“Pearl Meyer”) as its independent compensation consultant to annually reviewNon-Employee Director compensation based on an analysis of the compensation paid to thenon-employee directors of companies included in the same compensation peer group used to annually review executive compensation. ForAfter considering Pearl Meyer’s 2018 review ofNon-Employee Director compensation, in March 2018, the 2015-2016Compensation Committee recommended the followingNon-Employee Director compensation for the 2018-2019 director term, the annual cash retainer and additional annual amounts paid to the non-employee directors in respect of their roles as members or chairmen of committees, as Chairman ofwhich was approved by the Board and as Lead Independentin May 2018.

2018-2019 Director and meeting attendance fees were as follows:Term - Annual Cash Retainers | | Board of

Directors | Audit | Compensation | Nominating

and Corporate

Governance | | Annual Cash Retainer | $60,000 | | | | | Chairman of the Board of Directors | 120,000 | | | | | Lead Independent Director | 26,500 | | | | | Committee Chairman | | $20,000 | $10,000 | $10,000 | | Committee Member | | 9,000 | 5,000 | 3,000 | | Meeting Attendance | 2,500 | 1,000 | 1,000 | 1,000 | | Meeting Attendance via Teleconference | 1,000 | 500 | 500 | 500 | | Special Meeting Attendance | 1,000 | | | | | Special Meeting Attendance via Teleconference | 500 | | | |

| | | | | | | | | | | | | | | | | | | | Board of Directors | | | Audit | | | Compensation | | | Nominating and Corporate Governance | | Board Member | | | $80,000 | | | | | | | | | | | | | | Chairman of the Board of Directors | | | 120,000 | | | | | | | | | | | | | | Lead Independent Director | | | 27,500 | | | | | | | | | | | | | | Committee Chairman | | | | | | $ | 37,500 | | | | $30,000 | | | | $15,000 | | Committee Member | | | | | | | 27,500 | | | | 20,000 | | | | 7,500 | |

2018-2019 Director Term - Annual Equity Retainers | | | | | | | | | | | | | | | | | | | | | | | | | Board of Directors | | | Audit | | | Compensation | | | Nominating and Corporate Governance | | | | | | | Board Member | | | $80,000 | | | | | | | | | | | | | | | | | | | Chairman of the Board of Directors | | | 120,000 | | | | | | | | | | | | | | | | | | | Lead Independent Director | | | 27,500 | | | | | | | | | | | | | | | | | | | Committee Chairman | | | | | | $ | 37,500 | | | | $30,000 | | | | $15,000 | | | | | | | Committee Member | | | | | | | 27,500 | | | | 20,000 | | | | 7,500 | |

The non-employee directors’ cashnumber of RSUs granted toNon-Employee Directors is based on the annual equity retainers shown in the table above, divided by the closing stock price of our common stock on the NASDAQ Global Select Market on the grant date. See “2018 Director

PROPOSAL 1. ELECTION OF DIRECTORS Compensation” table below for details of the RSUs granted to theNon-Employee Directors during 2018. After considering Pearl Meyer’s 2019 review ofNon-Employee Director compensation, in February 2019, the Compensation Committee recommended theNon-Employee Director compensation for the 2016-20172019-2020 director term, is expected to remain the same as theNon-Employee Director compensation for the 2015-20162018-2019 director term except for the amount paid in respect of the role as chairman of the Compensation Committee, which will be increased to $15,000 per year. Under the Incentive Plan, non-employee directors may be granted stock options, restricted stock, restricted stockpresented above.

units or any combination of such awards for their service to the Board at the discretion of the Board of Directors or the Compensation Committee. Awards may be made to non-employee directors in respect of their roles as members or chairmen of committees, as Chairman of the Board and as Lead Independent Director. Awards are also granted to non-employee directors upon joining the Board and after each annual shareholder meeting.

For the 2015-2016 director term, non-employee directors were awarded the following shares of restricted stock units:

| | Board of

Directors | Audit | Compensation | Nominating

and Corporate

Governance | | Director | 2,500 | | | | | Chairman of the Board of Directors | 3,900 | | | | | Lead Independent Director | 500 | | | | | Committee Chairman | | 1,750 | 1,050 | 400 | | Committee Member | | 1,050 | 700 | 300 |

Because future awards are at the discretion of the Board and Compensation Committee, the number of shares subject to future awards could increase or decrease and the type and terms of future awards could change as well, in each case in accordance with the Incentive Plan. The vesting terms of any stock options or shares of restricted

stock and restricted stock units granted to directors are at the discretion of the Compensation Committee or the Board of Directors. Director awards for the 2016-2017 director term are currently expected to remain the same as for the 2015-2016 term.

PROPOSAL 1. ELECTION OF DIRECTORS

2018 Director Compensation The following table summarizes the cash and equity-based compensation earned or paid to each of our non-employee directorsNon-Employee Directors during 2015 and stock awards granted for the 2015-2016 director term.2018. | | | | | | | | | | | | | | | | | | Name | | Fees Earned or Paid in Cash(1) | | | Stock Awards(2) | | | Total | | Steven A. Webster | | | $198,750 | | | | $200,009 | | | $ | 398,759 | | F. Gardner Parker | | | 160,000 | | | | 165,020 | | | | 325,020 | | Frances Aldrich Sevilla-Sacasa | | | 89,938 | | | | 126,802 | | | | 216,740 | | Thomas L. Carter, Jr. | | | 119,688 | | | | 122,506 | | | | 242,194 | | Robert F. Fulton | | | 104,875 | | | | 107,514 | | | | 212,389 | | Roger A. Ramsey | | | 132,875 | | | | 137,526 | | | | 270,401 | | Frank A. Wojtek | | | 86,563 | | | | 87,516 | | | | 174,079 | |

Name | Fees Earned or

Paid in Cash | Stock

Awards(1) | Option

Awards | All Other

Compensation |

Total | | Steven A. Webster | $175,500 | $327,584(2) | $ — | $ — | $503,084 | | Thomas L. Carter, Jr. | 86,125 | 202,181 | — | — | 288,306 | | Robert F. Fulton | 74,000 | 179,148 | — | — | 253,148 | | F. Gardner Parker | 113,563 | 278,958 | — | — | 392,521 | | Roger A. Ramsey | 85,125 | 235,451 | — | — | 320,576 | | Frank A. Wojtek | 68,125 | 143,318 | — | — | 211,443 |

| (1) | Represents the portions of the annual cash retainers for the 2017-2018 director term and the 2018-2019 director term paid in 2018, except for Ms. Aldrich Sevilla-Sacasa who was paid $14,000 for her service on the Board from March 23, 2018, the date of her appointment, through May 22, 2018, the end of the 2017-2018 director term. |

| (2) | Represents the aggregate grant date fair value of restricted stock unitsRSUs granted on May 19, 2015 for the 2015-20162018-2019 director term, computed in accordance with FASB ASC Topic 718. Theand for Ms. Aldrich Sevilla-Sacasa, also includes the aggregate grant date fair value of $51.19 per share isRSUs granted for her service on the Board from the date of her appointment through the end of the 2017-2018 director term. The grant date fair values, computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, are based on the average of the high and lowclosing stock price of our Common Stockcommon stock on the NASDAQ Global Select Market on the May 19, 2015 grant date.dates. The number of RSUs granted to eachNon-Employee Director during 2018 is presented in the table below. |

| | | | | | | | | | | | | | | | | | Name | | Grant

Date | | | Number of

Shares

Granted (#) | | | Grant Date

Stock Price | | | Grant Date Fair

Value of Stock

Awards ($) | | Steven A. Webster | | | 7/2/2018 | | | | 7,231 | | | | $27.66 | | | | $200,009 | | F. Gardner Parker | | | 7/2/2018 | | | | 5,966 | | | | 27.66 | | | | 165,020 | | Frances Aldrich Sevilla-Sacasa | | | 4/4/2018 | | | | 1,250 | | | | 15.43 | | | | 19,288 | | Frances Aldrich Sevilla-Sacasa | | | 7/2/2018 | | | | 3,887 | | | | 27.66 | | | | 107,514 | | Thomas L. Carter, Jr. | | | 7/2/2018 | | | | 4,429 | | | | 27.66 | | | | 122,506 | | Robert F. Fulton | | | 7/2/2018 | | | | 3,887 | | | | 27.66 | | | | 107,514 | | Roger A. Ramsey | | | 7/2/2018 | | | | 4,972 | | | | 27.66 | | | | 137,526 | | Frank A. Wojtek | | | 7/2/2018 | | | | 3,164 | | | | 27.66 | | | | 87,516 | |

Stock Ownership Guidelines Non-Employee Directors must own shares equal to three times their annual cash retainer for Board membership. Upon appointment as aNon-Employee Director, the individual has a five-year period in which to comply with the stock ownership guidelines. As of March 20, 2019, allNon-Employee Directors were in compliance with the stock ownership guidelines. | (2) | As of December 31, 2015, Mr. Webster held 41,672 exercisable stock appreciation rights, of which 18,332 were granted on June 3, 2009 and 23,340 were granted on July 13, 2010, that will be settled in cash. | | |

| | 20162019 PROXY STATEMENT

| 18 | | 19 |

EXECUTIVE OFFICERS The following table sets forth certain information as of March 21, 201620, 2019 with respect to the executive officers. Executive Officer | Age | Position | | | | | | | Executive Officer | | Age | | Position | S.P. Johnson IV | 60 | 63 | | President and Chief Executive Officer and Director | Brad Fisher | 55 | 58 | | Vice President and Chief Operating Officer | David L. Pitts | | 52 | | Vice President and Chief Financial Officer | Gerald A. Morton | 57 | 60 | | General Counsel and Vice President of Business Development | David L. Pitts | 49 | Vice President and Chief Financial Officer | Richard H. Smith | 58 | 61 | | Vice President of Land | Gregory F. Conaway | 40 | 43 | | Vice President and Chief Accounting Officer |

Set forth below is certain background information of each of our executive officers (other than Mr. Johnson, whose background is described above under “Proposal 1. Election of Directors”). Brad Fisher has served as Vice President and Chief Operating Officer since March 2005. Prior to that time, he served as Vice President of Operations since July 2000 and General Manager of Operations from April 1998 to June 2000. Prior to joining us, Mr. Fisher spent 14 years with Cody Energy and its predecessor Ultramar Oil & Gas Limited where he held various managerial and technical positions, last serving as Senior Vice President of Engineering and Operations. Mr. Fisher holds a B.S. degree in Petroleum Engineering from Texas A&M University. Gerald A. Morton has served as General Counsel and Vice President of Business Development of the Company since 2008. Prior to joining the Company, Mr. Morton spent 15 years with Pogo Producing Company, where he held various positions including Vice President – Law, Corporate Secretary, and Senior Vice President for Asia and Pacific operations. Mr. Morton began his oil industry career in 1982 working for Texaco as a geophysicist. Mr. Morton graduated from Brigham Young University with an Engineering Geology degree. He received his MBA in Finance in 1985 and a law degree in 1988, both from the University of Houston.

David L. Pitts has served as Vice President and Chief Financial Officer since August 2014. Mr. Pitts also served as Treasurer from August 2014 to March 2015 and Vice President and Chief Accounting Officer from January 2010 to September 2014. Prior to joining us, he served as an audit partner with Ernst & Young LLP. Prior to his employment at Ernst &Young& Young LLP from 2002 to 2009, Mr. Pitts was a senior manager with Arthur Andersen. Mr. Pitts is a CPA and holds a B.S. in Accounting and Business from Southwest Baptist University. Gerald A. Morton has served as General Counsel and Vice President of Business Development since 2008. Prior to joining us, Mr. Morton spent 15 years with Pogo Producing Company, where he held various positions including Vice President – Law, Corporate Secretary, and Senior Vice President for Asia and Pacific Operations. Mr. Morton began his oil and gas industry career in 1982 working for Texaco as a geophysicist. Mr. Morton graduated from Brigham Young University with an Engineering Geology degree. He received his MBA in Finance in 1985 and a law degree in 1988, both from the University of Houston. Richard H. Smith has served as Vice President of Land since August 2006. Prior to joining us, Mr. Smith held the position of Vice President of Land for Petrohawk Energy Corporation from March 2004 through August 2006. Mr. Smith served with Unocal Corporation from April 2001 until March 2004 where he held the position of Land Manager – Gulf Region USA with areas of concentration in the Outer Continental Shelf, Onshore Texas and Louisiana, and Louisiana State Waters. From September 1997 until March 2001, Mr. Smith held the position of Land Manager – Gulf Coast Region with Basin Exploration, Inc. Mr. Smith held various land management positions with Sonat Exploration Company, Michel T. Halbouty Energy Co., Pend Oreille Oil & Gas Company, and Norcen Explorer, Inc. from the time he began his career in 1980 until the time he joined Basin Exploration. Mr. Smith is a Certified Professional Landman with a B.B.A. in Petroleum Land Management from the University of Texas at Austin.

EXECUTIVE OFFICERS Gregory F. Conaway has served as Vice President and Chief Accounting Officer since September 2014. Mr. Conaway joined the Company in July 2011 serving as Assistant Controller — Financial Reporting and served as Controller — Financial Reporting from May 2012 to September 2014. Prior to joining us, Mr. Conaway worked for Ernst & Young LLP, holding positions of increasing responsibility including senior manager. Mr. Conaway began his career with Arthur Andersen in 1998. Mr. Conaway is a CPA and holds a M.B.A. and B.B.A. in Accounting from Angelo State University. | | | | | | | 192019 PROXY STATEMENT

| CARRIZO OIL & GAS | |

21

EXECUTIVE COMPENSATION Compensation Discussion and Analysis This section describes the objectives and components of the compensation program for our Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”) and each of our three other most highly compensated executive officers as of December 31, 2018, whom we collectively refer to as our “Named Executive Officers” and were as follows: S.P. Johnson IV, President and Chief Executive Officer Brad Fisher, Vice President and Chief Operating Officer David L. Pitts, Vice President and Chief Financial Officer Gerald A. Morton, General Counsel and Vice President of Business Development Richard H. Smith, Vice President of Land This Compensation Discussion and Analysis is divided into four sections: Section 1 - Executive Summary Section 2 - Executive Compensation Program Objectives Section 3 - Executive Compensation Components Section 4 - Tax Considerations of Executive Compensation Section 1 - Executive Summary 2015 Performance HighlightsThe Compensation Committee oversees our compensation programs. Our compensation programs are designed to specifically address our desire to motivate and retain all of our employees.

Our executive compensation program is focused on tying a substantial portion of our Named Executive Officers total compensation to the Company’s performance in order to incentivize them to consistently build long-term shareholder value and to align the interests of our executives with those of our shareholders. The following Compensation Discussion and Analysis explains how the Compensation Committee has structured our executive compensation program to achieve these objectives. Summarized below are someAlthough this section of the many objectivesproxy statement specifically addresses the compensation program of our Named Executive Officers, we accomplished during 2015are focused on the compensation of all of our employees and structuring all of our compensation programs to reward behavior that we believe will help us navigate a tough commodity price environment.ultimately increase shareholder value.

2018 Performance Highlights | · | Increased average daily oil production 22% year-over-year to 23,054 Bbls/d in 2015, exceeding our initial expectations of 17%, despite reducing capital expenditures by 37%; |

During 2018, we executed on the plan that we began in 2017 to streamline our portfolio and focus on our highest-return plays in the Eagle Ford and Delaware Basin by continuing to build our Delaware Basin position through the acquisition of approximately 10,000 netbolt-on acres and divestingnon-core operations in the Niobrara as well as a portion of our assets in the Eagle Ford. Increased daily total production by 12% and daily crude oil production by 13% year over year to 60,382 Boe/d and 38,992 Bbls/d, respectively, in 2018; | · | Reduced average well costs in the Eagle Ford from $7.5 million at year-end 2014 to $4.6 million at year-end 2015; | | | | | | 22 | | | CARRIZO OIL & GAS | | |

EXECUTIVE COMPENSATION Shifted capital from the Delaware Basin to the Eagle Ford to take advantage of the superior returns that were offered from the play during 2018 as a result of weak local market pricing in the Delaware Basin; Improved our unhedged EBITDA margin by approximately 37% from $26.24/Boe in 2017 to $35.90/Boe in 2018; Increased our net acreage position in the Delaware Basin to over 46,000 net acres atyear-end 2018 with the acquisition of approximately 10,000 net acres from Devon Energy Production Company, L.P.; Redeemed $50.0 million of our outstanding Preferred Stock; Redeemed the remaining $450.0 million of our 7.50% Senior Notes, where approximately 90% of the proceeds for the redemptions were from divestitures of non-core assets; Reduced our ratio of Total Debt to EBITDA from 2.59 to 1.00 at year-end 2017 to 2.41 to 1.00 at year-end 2018, both calculated as defined under the terms of our credit agreement; Increased the borrowing base under our revolving credit facility from $830.0 million to $1.3 billion, primarily as a result of the continued development of our Eagle Ford and Delaware Basin assets; Increased proved reserves fromyear-end 2017 by 26% to 329.4 MMBoe, of which 55% was crude oil; Increased ouryear-end 2018 proved developed reserves to 130.9 MMBoe, a 20% increase fromyear-end 2017; and Exited 2018 withPV-10 of $4.1 billion, an increase of 55% versus year-end 2017; | · | Utilizing new Generation 3 rigs, reduced drilling days for long-lateral wells in the Eagle Ford from 16 in 2014 to an average of 9 by year-end 2015; | | |

| · | Maintained a strong balance sheet, exiting 2015 with a Net Debt to Adjusted EBITDA ratio of 2.7x and an undrawn $685.0 million revolving credit facility (borrowings subject to compliance with covenants);2019 PROXY STATEMENT | | 23 |

| · | Hedged approximately 60% of our estimated crude oil production for 2016 at a weighted-average floor price of approximately $57/Bbl, with an additional $44.8 million of cash flow during 2016 relating to the offsetting hedge transactions entered into during the first quarter of 2015; and |

| · | Reduced our annual interest expense by $11.1 million on a go-forward basis by replacing $600.0 million of 8.625% Senior Notes with $650.0 million of 6.25% Senior Notes, also extending the maturity of the notes from 2018 to 2023. |

Despite our achievements in 2015, the continued low commodity price environment negatively impacted our financial results and stock price. In light of the current commodity price environment, management recommended and the Compensation Committee approved, the following key actions in 2015:

| · | No change to base salaries of named executive officers; and |

| · | Reduced 2015 annual incentive bonus payouts to 50% of the target levels. |

See “Non-GAAP Financial Measures” in Annex A to this proxy statement.

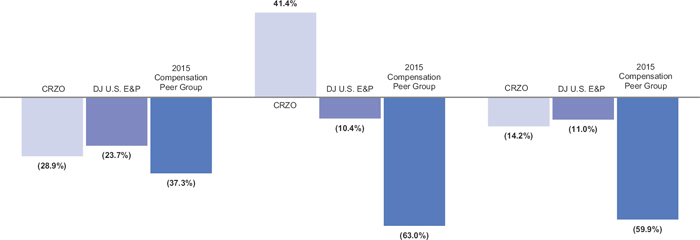

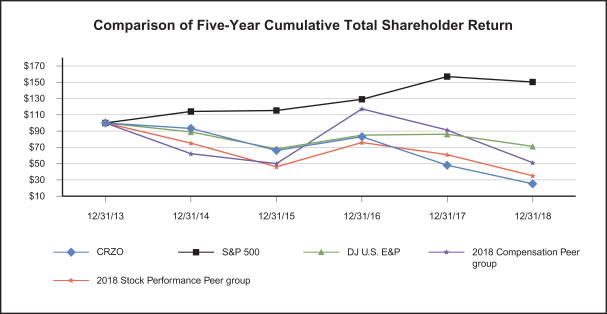

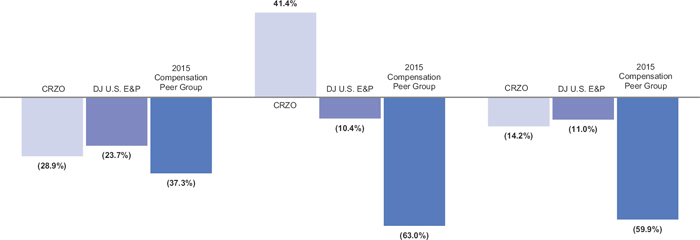

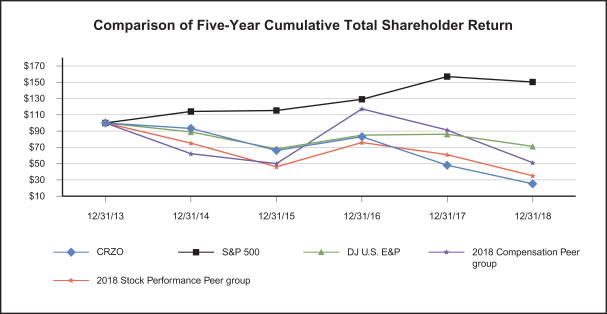

EXECUTIVE COMPENSATION Pay For Performance: Total Shareholder Return The oil and gas industry has experienced a continued low commodity price environment stemming in large part fromfollowing graph compares the global oversupply of crude oil. While the Company has no control over commodity prices, we believe we have positioned the Company to better manage this challenging commodity price environment by controlling capital costs and maintaining financial flexibility, better than manycumulative total shareholder return (“TSR”) of our industry peers, including many of those in our 2015 Compensation Peer Group, as defined below. The following graph displays a comparison of one-year, three-year, and five-year total shareholder returns of the Company’s common stock over the five-year period ended December 31, 2018 with that of the average returns of our 2015 Compensation Peer Groupcumulative TSR for the same period for the Standard and Poor’s 500 (“S&P 500”) Index, the Dow Jones U.S. Exploration &and Production Index.(“DJ U.S. E&P”) Index, our 2018 Compensation Peer Group, and our 2018 Stock Performance Peer Group.

The cumulative TSR assumes that $100 was invested, including reinvestment of dividends, if any, in our common stock on December 31, 2013, and in each of the S&P 500 and DJ U.S. E&P indexes and in each of the 2018 Compensation and Stock Performance Peer Groups on the same date. The results shown in the graph below are not necessarily indicative of future performance. One-Year | Three-Year | Five-Year | (12/31/2014 - 12/31/2015) | (12/31/2012 - 12/31/2015) | (12/31/2010 - 12/31/2015) |

As shown above, for the one-year, three-year and five-year periods, we have performed better than our 2015 Compensation Peer Group. We view this asThe DJ U.S. E&P Index is a testament to management’s ability to position the Company for success during a challenging commodity pricing environment and to have protected our investors

during this period better than the majorityweighted composite of other64 companies in our 2015the oil and gas exploration and production industry. See “Section 2—Executive Compensation Peer Group. See also “Executive Compensation Objectives and Features—Program Objectives—Compensation Should be Benchmarked” for more information ona listing of the companies

included in our 20152018 Compensation Peer Group and “Section 3—Executive Compensation Components—Long-Term Equity-Based Incentive Awards” for a listing of the companies included in our 2018 Stock Performance Peer Group.

EXECUTIVE COMPENSATION

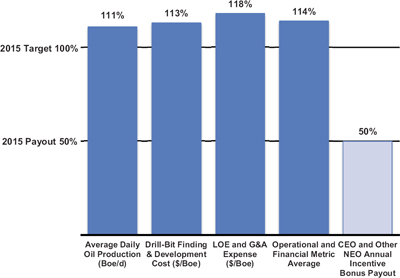

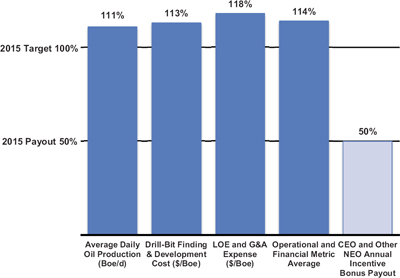

Pay-for-Performance: Tying Payouts to Performance Despite a challenging commodity price environment during 2015, the leadership team was able to deliver on all operational and financial metrics used by our

SignificantAt-RiskCompensation Committee to determine annual incentive bonuses. The following chart displays the Company’s performance relative to the target for each metric.

Our leadership team executed beyond the average targeted performance levels for each metric, with an average of 114%. Despite actual results exceeding target performance levels, management recommended, and

the Compensation Committee approved, the exercise of negative discretion to reduce the payout of the annual incentive bonuses to 50% of the target level due to the continued depressed commodity price environment.

Pay-for-Performance: Increased At-Risk Compensation

The Compensation Committee reviews and adjusts the compensation of the executive officersour executives each year to ensure the programs aligncontinued alignment with the goals and objectives of the Company, as well as motivate executives to maximize long-termlong- term value creation for our shareholders. This has been accomplished by continuing to implementweight a significant portion our executive total compensation programs weighted toward towardsat-risk, performance-based variable compensation. As discussed in more detail under “Executive Compensation Components,” the at-risk compensation consists of a metric-driven annual incentive program and total shareholder return (“TSR”) contingent equity awards. Although our restricted stock units have a production target and therefore contingent on operational accomplishments, we do not classify them as performance-based compensation for purposes of a pay-for-performance discussion even though these awards are designed to be qualified performance-based compensation within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

| | | | | | | | 24 | | | 2016 PROXY STATEMENTCARRIZO OIL & GAS

| 22 | |

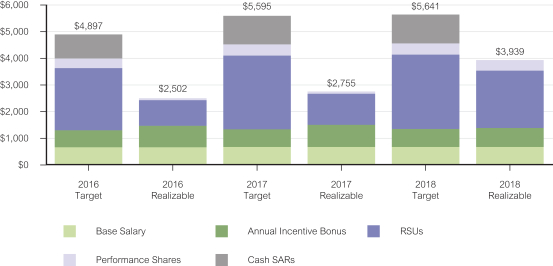

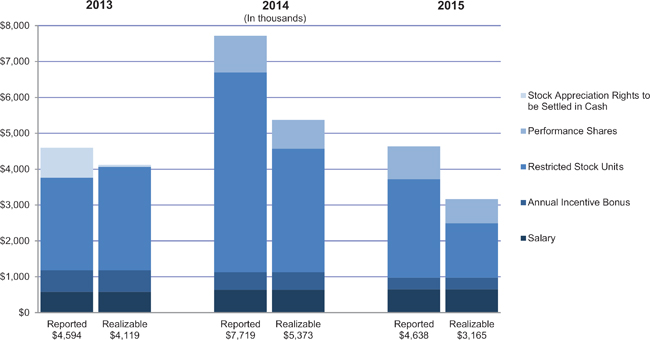

EXECUTIVECOMPENSATION 2015Effect of Company Share Price Performance on Chief Executive Officer Realizable Compensation

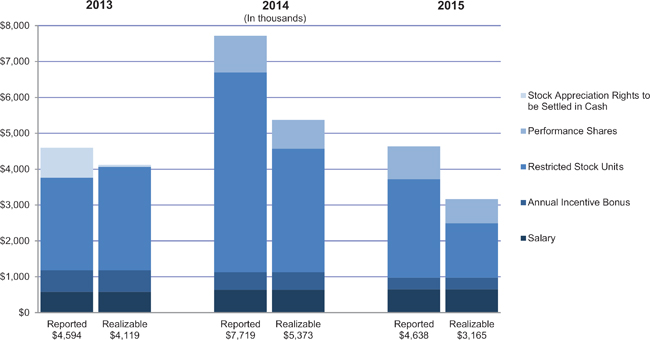

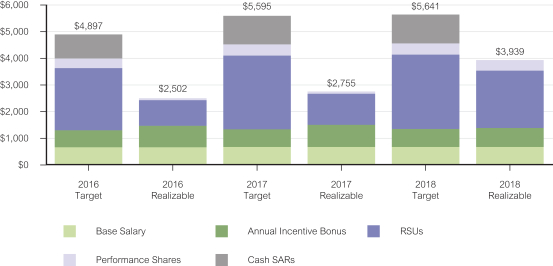

The most significant component of our CEO’s variable,at-risk compensation is long-term equity-based incentive awards which consist of RSUs, Cash SARs, and performance shares. Our CEO’s realizable compensation varies significantly based on changes in the Company’s share price. Realizable compensation is not a substitute for targeted compensation in evaluating our executive compensation, but we believe it is important to understand the impact the Company’s share price performance has on our CEO’s realizable compensation. The following chart demonstrates how the Company’s share price performance significantly impacts our CEO’s realizable compensation. Target Compensation vs. Realizable Compensation (In thousands)

Target compensation is calculated as the sum of base salary, target annual incentive bonus, and the grant date fair value of long-term equity-based incentive awards. Realizable compensation is calculated as the sum of base salary, actual annual incentive bonus paid, and the intrinsic value of the long-term equity-based incentive awards based on the closing price of our common stock on the NASDAQ Global Select Market on December 31, 2018 of $11.29 per share. The intrinsic value of the long-term equity-based incentive awards is calculated as follows: for RSUs, the closing share price on December 31, 2018 multiplied by the number of RSUs granted in each year; for performance shares, the closing share price on December 31, 2018 multiplied by the number of performance shares granted in each year and the applicable payout multiplier as if December 31, 2018 was the end of the performance period; and for Cash SARs, the closing share price on December 31, 2018 minus the Cash SARs exercise price multiplied by number Cash SARs granted in each year. Because the closing share price on December 31, 2018 was less than the exercise prices of the Cash SARs granted for each year presented in the table above, the intrinsic value of the Cash SARs is zero for each year.

EXECUTIVE COMPENSATION Our CEO’s realizable compensation is 51%, 49%, and 70% of target compensation for 2016, 2017, and 2018, respectively, primarily due to declines in the Company’s share price and demonstrates the significant impact our Company’s share price performance has on our CEO’s realizable compensation. 2018 Shareholder Advisory Vote on Executive Compensation At our 2018 Annual Meeting of Shareholders, holders of 94.1% of the 2015 annual meeting of shareholders, our shareholdersshares entitled to vote on the matter voted 92.8% in favor of the compensation of the named executive officersNamed Executive Officers as described in our 20152018 proxy statement. In considerationThe Compensation Committee interpreted this strong level of shareholder support as affirmation of the results,elements and objectives of the Company’s executive compensation program. Although the Compensation Committee acknowledged the support received from our shareholders and viewed the results of this advisory vote as a confirmationan indication from shareholders that no change to our executive compensation program was necessary, the Compensation Committee also considered information provided by its independent compensation consultant, including compensation decisions made by the compensation committees of companies included in our 2018 compensation peer group, when determining whether changes to our executive compensation program were necessary in 2019. The Compensation Committee will continue to consider the results of the Company’s existingannual shareholder advisory vote on executive compensation when making future executive compensation decisions. compensation policies

EXECUTIVE COMPENSATION Executive Compensation Program and decisions. However, in efforts to continue improving on the compensation structures, the Compensation Committee reviewed actions taken by our 2015 Compensation Peer Group and public commentary by institutional investors in order to identify potential alterations to the 2015 compensation structure.

Corporate Governance Highlights We believe our annual incentive bonus and long-term equity-basedexecutive compensation for 2015 continue2018 continued to align our executives’ pay opportunities with the interests of our executives with those of our shareholders. Additionally, theThe following table summarizes the compensation best practices that we follow and the disfavored compensation practices that we avoid. | | | | Compensation Best Practices That We Follow | þ | | | ✓ | | Pay for PerformanceMajority “At-Risk” or Variable Compensation..We tie pay to performance. A significant portion The majority of our executive paycompensation is “at-risk” or variable. Our annual incentive bonus is based uponon performance relative to key operational and not guaranteed. We have established clear financial and operational goals for corporate performance and differentiate based on individual achievement. In establishing goals, we select performance metrics that drive both our short-term and long-term corporate strategy in accordance withstrategy. The value delivered by our strategic plan.long-term equity-based incentive awards is tied to both absolute share price performance as well as share price performance relative to our peers.

| þ | Mitigate Undue Risk.We mitigate undue risk associated with compensation, including utilizing retention provisions, multiple performance metrics and robust board and management processes to identify risk. | þ✓ | Minimal Perquisites.We provide only minimal perquisites to the named executive officers that are not generally available to all employees. | þ | Regular Review of Share Utilization.We evaluate share utilization by reviewing overhang levels (dilutive impact of equity compensation on our shareholders) and annual run rates (the aggregate shares awarded as a percentage of total outstanding shares). | þ | Stock Ownership Guidelines.The Company requires its non-employee directors Named Executive Officers and named executive officersNon-Employee Directors are required to acquire and maintain prescribed levels ofmeaningful ownership of our stock in order to alignensure their interestinterests are closely aligned with thosethe interests of our shareholders. These guidelines require that within a five year period from the date a person | | | | ✓ | | Independent Compensation Committee. Our Compensation Committee is appointedcomprised solely of independent directors. | | | | ✓ | | Independent Compensation Consultant. The Compensation Committee retains an independent compensation consultant who provides no other services to the Board of Directors or becomes a named executive officer, they must hold Company common stock in value equal to three times their annual cash retainer for service on the Board of Directors for non-employee directors, five times their annual base salary for the Chief Executive Officer and Chief Financial Officer and three times their annual base salary for other named executive officers.Company. | þ | | | ✓ | | Compensation Benchmarking. The Compensation Committee annually reviews the composition of the peer group of companies and analysis of executive compensation prepared by its independent compensation consultant using market-based compensation data to ensure our executive compensation program is designed appropriately and takes into account market changes. | | | | ✓ | | Compensation Risk Assessment. There is an appropriate balance between long-term and short-term focus in our compensation programs and the Compensation Committee has the ability to exercise discretion to ensure risk mitigation occurs in management decision making. | | | | ✓ | | Clawback Policy.The Compensation CommitteeBoard of Directors is committed to institutingadopting a clawback policy as required by Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 when final regulations are providedadopted by the SEC and the NASDAQ Stock Market and become effective.NASDAQ. | þ | | | ✓ | | Independent Compensation Consulting Firm.Minimal Perquisites.The Compensation Committee benefits from its utilization of an independent compensation consulting firm, Longnecker, which provides no We provide minimal perquisites to our Named Executive Officers that are not generally available to all other services to the Company.employees.

|

EXECUTIVE COMPENSATION | | | | Disfavored Compensation Practices That We Avoid | ☒ | | | × | | No Liberal Share Counting.Recycling.Our Neither the Prior Incentive Plan does not containnor the 2017 Incentive Plan contains liberal share counting provisions whereby shares granted and exercised can, under certain circumstances, be added back to the plan reserve for future grants.recycling. | ☒ | | | × | | No Re-Pricing.Repricing.No re-pricingrepricing or exchange of underwater stock options or stock appreciation rights.SARs or other awards is permitted without shareholder approval. | ☒ | | | × | | No Payment of Dividends Prior to Vesting. No payment of dividends prior to the vesting of restricted stock or performance shares. | | | | × | | No Hedging or Derivatives Trading of the Company’s Securities.No hedging of the Company’s securities, including publicly traded options, puts, calls and short sales by named executive officersNamed Executive Officers or directorsNon-Employee Directors permitted. | ☒ | | | × | | No Guaranteed Bonus.No guaranteed annual incentive bonus and no cash retention bonus for named executive officers.Named Executive Officers. | ☒ | | | × | | No Future Agreements to Provide TaxGross-ups.The Board adopted a policy in May 2011No employment or other agreements that employment agreements entered after the adoption of such policy would not contain provisions entitling employees to taxgross-up payments. | ☒ | | | × | | No Single Trigger Cash Severance upon a Change in Control. The Company’s Change in Control Severance Plan requires a “double trigger” for cash severance. | | | | × | | No Supplemental Executive Retirement Plans.Benefits.We do not offer Supplemental Executive Retirement Plansprovide pensions or other supplemental executive retirement benefits to our executive officers.Named Executive Officers. |

Section 2 - Executive Compensation Program Objectives Provide competitive total compensation opportunities that allow us to attract, retain, reward, and motivate talented management.We evaluate the range of current industry compensation practices to provide external benchmarks that help to guide our executive compensation structure. Unless circumstances warrant otherwise, we generally target executive total direct compensation near the market median of executives in equivalent positions at comparable companies, considering individual performance, responsibilities, experience, leadership, and contributions as well as the Company’s financial, operational, and share price performance. Support a performance-based culture.Our executive compensation program is intended to provide the appropriate balance between fixed and variable compensation, cash and equity-based compensation, and short-term and long-term incentives with the majority of each executive’s total compensation “at-risk” or variable based on a combination of attainment of short-term goals in support of our Company’s long-term strategy and long-term stock performance both on an absolute basis and relative to our peer companies. Our program is structured to require a commitment to performance because total compensation at the market is not guaranteed. Therefore, our program is designed to reward above-target compensation when performance is warranted and below-target compensation when performance does not meet expectations. Align our executives’ interests with those of our shareholders.We believe that we achieve alignment of executives’ and shareholders’ interests by providing a substantial portion of total compensation in the form of long-term equity-based incentives that tie executive pay to stock price performance and through stock ownership guidelines that ensure our executives have a meaningful ownership stake in the Company. Encourage appropriate risk management.We believe that effective leadership requires taking prudent business risks while

EXECUTIVE COMPENSATION discouraging excessive risk-taking. To encourage this balance, we have structured our compensation programs to include approximate three-year vesting schedules on long-term equity-based incentive awards and an annual incentive bonus using a combination of short-term financial and operational objectives. We also mitigate risk by exercising discretion in determining the payout of annual incentive bonuses rather than relying solely on a formula. We regularly review our compensation programs to ensure that our executives are not encouraged to take inappropriate or excessive risks. EXECUTIVECOMPENSATION

OversightResponsibilities of the Compensation ProgramsCommittee

The Compensation Committee is composed entirely of independent, non-employee directors.oversees the Company’s compensation programs, administers the 2017 Incentive Plan, the Prior Incentive Plan, and the Cash SAR Plan, and reviews and approves all compensation decisions relating to our executives. The Compensation Committee has overall responsibility for settingis authorized by the Board of Directors and the Compensation Committee Charter to make all the decisions regarding compensation for executives without ratification or other action by the Chief Executive Officer and for approving the compensationBoard of the other executive officers, including the other named executive officers.Directors. The Compensation Committee also oversees and advises the Board of Directors on the adoption of policies that govern the Company’s compensation programsprograms. Independent Compensation Consultant Pearl Meyer serves as independent compensation consultant for and administersreports directly to the Company’s Incentive Plan and Cash- Settled Stock Appreciation Rights Plan. TheCompensation Committee. Representatives of Pearl Meyer attend Compensation Committee regularly meetsmeetings, as requested, and communicate with its independent executive compensation consultant, Longnecker, whothe Compensation Committee informally between meetings as necessary. Pearl Meyer assists and advises the Compensation Committee on all aspects of itsour executive compensation program. Longnecker provides no other services toServices provided by the Company. The services Longnecker providesindependent compensation consultant include: | · | analyzing the appropriateness of the 2015 Compensation Peer Group and 2015 Stock Performance Peer Group (discussed below); |

| · | providing and analyzing competitive market compensation data; |

| · | analyzing the effectiveness of executive compensation programs and making recommendations to the Compensation Committee, as necessary; and |

| · | evaluating how well our compensation programs adhere to the philosophies and principles of the Company. |

The Compensation Committee also receives data, advice and counsel from Longnecker on matters pertaining to director compensation.

Executive Compensation Objectives and Features

Objectives

The guiding philosophyreviewing the compensation and specific objectivesstock performance peer groups and recommending changes, as necessary;

reviewing executive compensation based on an analysis of market-based compensation data; analyzing the effectiveness of our executive compensation program are: (1) to alignand recommending changes, as necessary; and evaluating how well our executive compensation design and outcomes with our business strategy; (2)adheres to encourage management to create sustained value for our shareholders; (3) to attract, retain, and engage our executives; and (4) to support a performance-based culture for all of our employees. These primary objectives are evaluated annually by: (a) measuring and managing executive compensation; (b) aligning incentive plan goals with shareholder value-added measures; and (c) having an open and objective discussion between management andprogram objectives. To facilitate the Compensation Committee in setting goals for and measuring performance of the executive officers. We believe that eachdelivery of these objectives is important to our compensation program. Our compensation program is designed to reward our executives for meeting or exceeding short-term operational and financial targets and furthering the long-term strategy of the Company without subjecting the Company to excessive or unnecessary risk. Specifically, the components of our executives’ compensation, such as base salaries, annual incentive bonuses and long-term equity incentive awards, are evaluated and determined on a periodic basis to ensure the amount and type of compensation received by each executive corresponds to the executive’s performance and targets for the Company’s performance.

Compensation Philosophy

We target executive base salaries plus annual incentive bonus near the 50th percentile of market ranges for competitive performance and target total direct compensation near the 75th percentile, based on the Compensation Committee’s assessment of how the Company performed relative to the 2015 Compensation Peer Group. Total direct compensation is defined as base salary, plus annual incentive bonus, plus the three-year average of the grant date fair value of annual awards of restricted stock, performance share awards, and stock appreciation rights (of which all outstanding are expected to be settled in cash). Base salary is generally near the 50th percentile of base salary of executives with similar responsibilities at companies in our 2015

Compensation Peer Group. Our management annually reviews each executive’s performance, the performance of the Company and information regarding base salary and annual incentive bonus of executives in comparable positions with our 2015 Compensation Peer Group and makes a recommendationservices to the Compensation Committee, regarding each executive’s base salaryPearl Meyer interfaces with our management, particularly our CFO and annual incentive bonus forour Vice President of Human Resources. In 2018, Pearl Meyer did not provide any services to the applicable year. The annual incentive bonus is tied to a percentage of the executive’s base salary, with a pre-determined target percentage. See also “Annual Incentive Bonus.”

To determine the appropriate amount and mix of total compensation for each executive,Company other than those requested by the Compensation Committee reviewsand related to Pearl Meyer’s engagement as the recommendations madeindependent compensation consultant to the Compensation Committee.

Other than those services requested by

EXECUTIVECOMPENSATION

our management, information regarding total direct compensation paid by our 2015 Compensation Peer Group and other compensation survey information developed and provided by Longnecker. The Compensation Committee generally seeks to provide each executive total direct compensation with a target value near the 75th percentile of total direct compensation provided to executives with similar responsibilities within our 2015 Compensation Peer

Group. Based on its reviews of total direct compensation and such other factors, the Compensation Committee, believes thatPearl Meyer did not have any business or personal relationships with members of the total direct compensation paidCompensation Committee or executives of the Company, did not own any of the Company’s common stock and maintained policies and procedures designed to avoid such conflicts of interest. As such, the named executive officers isCompensation Committee determined the engagement of Pearl Meyer in line with the philosophy described above. However, compensation practices and philosophy are an evolving practice and future changes may be made to take into account changed circumstances, practices, competitive environments and other factors.2018 did not create any conflicts of interest.

Compensation Should beBe Benchmarked We operate in an environment where competition for executive talent is highly competitive. The Compensation Committee engages Longnecker to conduct annual assessments of our industry peer group in order to ensure each peer company remains appropriate. In order to accomplish this and position the Compensation Committee to make informed decisions, Longnecker assessed over 50 potential peer companies based on several metrics, including oil and gas revenue, assets, market capitalization, enterprise value and operational similarity. Longnecker narrows down potential peer companies based on a size similarity process whereby the best choice of peer companies in the oil and gas industry are within a range of 0.5 to 3.0 times the Company for the various metrics. Final peer company selections were made from within this group through discussions with Longnecker and our management for presentation to the Compensation Committee. The Compensation

Committee approves any revisions to the peer group on an annual basis. During this process, Longnecker and our management proposed, and the Compensation Committee approved, revisions to the industry peer group used in 2014 in connection with executive compensation decisions for 2015. As presented in the table below, two companies were removed, one as a result of being acquired and the other because its financial position no longer aligned with the Company. The additional companies in the 2015 industry peer group better align with the Company with respect to the operational metrics described above. The table below presents the 13 companies which comprise the industry peer group used in 2015 (the “2015 Compensation Peer Group”) in connection with executive compensation decisions, as well as changes to the Compensation Peer Group from 2014 to 2015:

| | | | Included in Compensation Peer

Group for Fiscal Year | | | 2014 | 2015 | | Bill Barrett Corporation | X | X | | Bonanza Creek Energy, Inc. | X | X | | Comstock Resources, Inc. | X | X | | EXCO Resources, Inc. | | X | | Gulfport Energy Corporation | X | X | | Halcòn Resources Corporation | X | X | | Kodiak Oil & Gas Corp.(1) | X | | | Laredo Petroleum, Inc. | X | X | | Midstates Petroleum Company, Inc. | | X | | Northern Oil and Gas, Inc. | X | X | | Oasis Petroleum Inc. | X | X | | PDC Energy, Inc. | X | X | | Resolute Energy Corporation | X | | | Rosetta Resources Inc.(2) | X | X | | Swift Energy Company | X | X |

| (1) | Effective December 8, 2014, Kodiak Oil & Gas Corp. was acquired by Whiting Petroleum Corporation. |

| (2) | Effective July 20, 2015, Rosetta Resources, Inc. was acquired by Noble Energy, Inc. |

EXECUTIVECOMPENSATION

The Compensation Committee uses this dataengages Pearl Meyer to annually review the compensation peer group used for executive compensation decisions. Pearl Meyer’s process considers the prior year compensation peer group as the starting point, and expands the pool of potential peers by reviewing peers of peers, peers identified by proxy advisory firms and other

EXECUTIVE COMPENSATION peers identified from analyst reports and independent research. Pearl Meyer refines its list of potential peers using criteria such as industry focus, corporate structure, operational similarity and financial size with a focus on identifying a peer group of15-20 domestic independent exploration and production companies with operations in either or both of the 2015 Compensation Peer GroupCompany’s two basins and where the Company is within a reasonable range of the peer group median for revenues and/or market capitalization with final peer group selections made after considering input from management. The resulting compensation peer group, along with any changes in conjunction with published industry survey data to benchmark our executives’ base salary, targeted annual incentive bonus, total cash compensation, long-term equity incentive compensationthe composition of the peer group, is reviewed and total direct compensation. Additionally,approved by the Compensation Committee usesCommittee. The compensation peer groups used for executive compensation decisions in 2017, 2018 and 2019 are presented in the data to evaluate how, for each executive position, thetable below. From 2017 to 2018, five companies were removed due to a lack of operational similarity as a result of the Company’s sale of its Utica, Marcellus, and Niobrara assets. In order to maintain an appropriately sized peer group, six companies were added that met the operational similarity, financial size and other criteria discussed above. From 2018 to 2019, two companies were removed as they no longer met the financial size criteria discussed above and in order to maintain an appropriately sized peer group, one company was added that met the operational similarity, financial size and other criteria discussed above. A separate peer group is used in connection with our performance share awards as described below under “Executive Compensation Committee’sComponents—Long-Term Equity-Based Incentive Awards—Performance Shares.” | | | | | | | | | | 2017 Compensation Peer Group | | 2018 Compensation Peer Group | | 2019 Compensation Peer Group | Bill Barrett Corporation | | X | | | | | Callon Petroleum Company | | | | X | | X | Centennial Resource Development, Inc. | | | | X | | X | Diamondback Energy, Inc. | | X | | X | | | Energen Corporation | | | | X | | X | EP Energy Corporation | | X | | X | | X | Gulfport Energy Corporation | | X | | | | | Halcón Resources Corporation | | | | | | X | Jagged Peak Energy Inc. | | | | X | | X | Laredo Petroleum, Inc. | | X | | X | | X | Matador Resources Company | | X | | X | | X | Oasis Petroleum Inc. | | X | | X | | X | Parsley Energy, Inc. | | X | | X | | X | PDC Energy, Inc. | | X | | X | | X | QEP Resources, Inc. | | | | X | | X | Range Resources Corporation | | X | | | | | Resolute Energy Corporation | | | | X | | X | Rice Energy Inc. | | X | | | | | RSP Permian, Inc. | | X | | X | | X | Sanchez Energy Corporation | | X | | X | | | SM Energy Corporation | | X | | X | | X | Whiting Petroleum Company | | X | | | | | WPX Energy, Inc. | | X | | X | | X | Total Number of Peers in Compensation Peer Group | | 16 | | 17 | | 16 |

EXECUTIVE COMPENSATION The Compensation Committee considers the results of Pearl Meyer’s executive compensation actionsreview to ensure that compensation decisions are appropriate, reasonable and consistent with the Company’s philosophy, practicescompensation program objectives and policies, considering the labor market incompetitive with executive compensation of companies against which we compete for business opportunities, investment dollars, and executive talent. To maintain independence and objectivity, the input and interpretation of data sources, methodology of consolidating data, and marketplace statistics included in Pearl Meyer’s executive compensation review were compiled without any input from management except for explanations of position functions. The Companymarket-based compensation data included in Pearl Meyer’s executive compensation review is based on compensation peer group proxy compensation data and published industry compensation survey data. Proxy data is generally nearfavored over survey data with the medianweighting based on the number of its selected industryposition matches available in the compensation peer group in relation to oil and gas revenue and enterprise value.group. Pearl Meyer’s 2018 executive compensation review was based on the following weighting: | | | | | | | | Named Executive Officer | | Number of Position Matches in 2018 Compensation Peer Group | | Proxy Data Weighting | | Survey Data Weighting | S. P. Johnson IV | | 17 | | 100% | | 0% | Brad Fisher | | 14 | | 100% | | 0% | David L. Pitts | | 15 | | 100% | | 0% | Gerald A. Morton | | 12 | | 70% | | 30% | Richard H. Smith | | 6 | | 50% | | 50% |

Section 3 - Executive Compensation Components TheOur executive compensation of the named executive officersprogram consists of the following components:

·long-term equityequity-based incentive awards;

·severance and change ofin control benefits; and

·perquisites and other benefits.

We believe that each of these components is necessary to achieve our objective of retaining highly qualified executives and motivating them to maximize shareholder return.

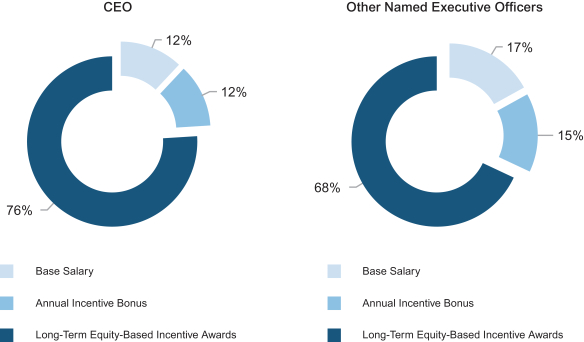

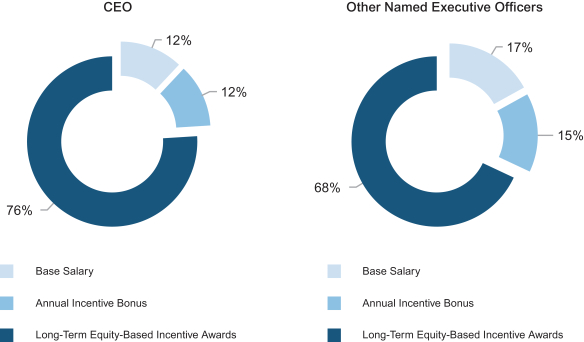

EXECUTIVE COMPENSATION 2018 Targeted Compensation Mix The charts below show the 2018 targeted total direct compensation mix of our Chief Executive Officer and other Named Executive Officers. As the charts illustrate, 88% and 83% of targeted total compensation for our Chief Executive Officer and other Named Executive Officers, respectively, is attributable to the performance-based annual incentive bonus and long-term equity-based incentive awards, and thus is variable and tied to performance (i.e. “at-risk”).